Discover Leading Wyoming Credit: Trusted Financial Institutions

Discover Leading Wyoming Credit: Trusted Financial Institutions

Blog Article

Opening the Perks of Cooperative Credit Union: Your Overview

In the realm of banks, lending institution stand as a commonly underexplored and unique alternative for those looking for a much more tailored approach to financial. As we dig right into the ins and outs of credit history unions, a world of advantages and possibilities unfolds, providing a glimpse right into a financial landscape where area values and member-focused solutions take spotlight. From their humble starts to their contemporary influence, comprehending the significance of lending institution might possibly reshape the means you see and manage your financial resources.

Background of Lending Institution

The principle of credit scores unions emerged as a response to the economic demands of people who were underserved by standard financial institutions. Friedrich Wilhelm Raiffeisen, a German mayor, is frequently attributed with establishing the very first modern-day credit scores union in the mid-1800s.

The idea of individuals collaborating to pool their resources and supply financial support to every other spread swiftly across Europe and later to The United States and Canada. In 1909, the very first cooperative credit union in the USA was developed in New Hampshire, noting the beginning of a brand-new period in community-focused banking. Ever since, cooperative credit union have actually proceeded to focus on the economic well-being of their members over revenue, personifying the cooperative principles of self-help, self-responsibility, freedom, solidarity, equality, and equity.

Membership Eligibility Requirements

Having developed a structure rooted in participating concepts and community-focused banking, cooperative credit union keep specific subscription qualification standards to make sure placement with their core worths and goals. These criteria typically focus on a typical bond shared by possible participants, which might include elements such as geographic area, employer, organizational affiliation, or subscription in a details community or organization. By needing participants to satisfy certain eligibility demands, cooperative credit union aim to promote a feeling of belonging and shared function among their members, strengthening the participating nature of these banks.

In addition to usual bonds, some credit rating unions may additionally prolong membership eligibility to family members of present participants or people who stay in the exact same home. This inclusivity aids lending institution broaden their reach while still staying real to their community-oriented principles. By keeping clear and clear subscription requirements, lending institution can ensure that their participants are actively participated in sustaining the cooperative worths and goals of the establishment.

Financial Services And Products

When considering the range of offerings offered, credit scores unions provide a varied range of financial products and solutions tailored to fulfill the one-of-a-kind needs of their participants. Participants frequently benefit from personalized consumer solution, as credit unions focus on constructing strong connections with those they serve.

In addition, cooperative credit union frequently use economic education and therapy to assist members improve their financial proficiency and make informed decisions. Several lending institution also join shared branching networks, permitting participants to access their accounts at a selection of places nationwide. In general, the variety of monetary services and products supplied by cooperative credit union emphasizes their commitment to meeting the varied requirements of their participants while prioritizing their financial health.

Benefits Over Typical Financial Institutions

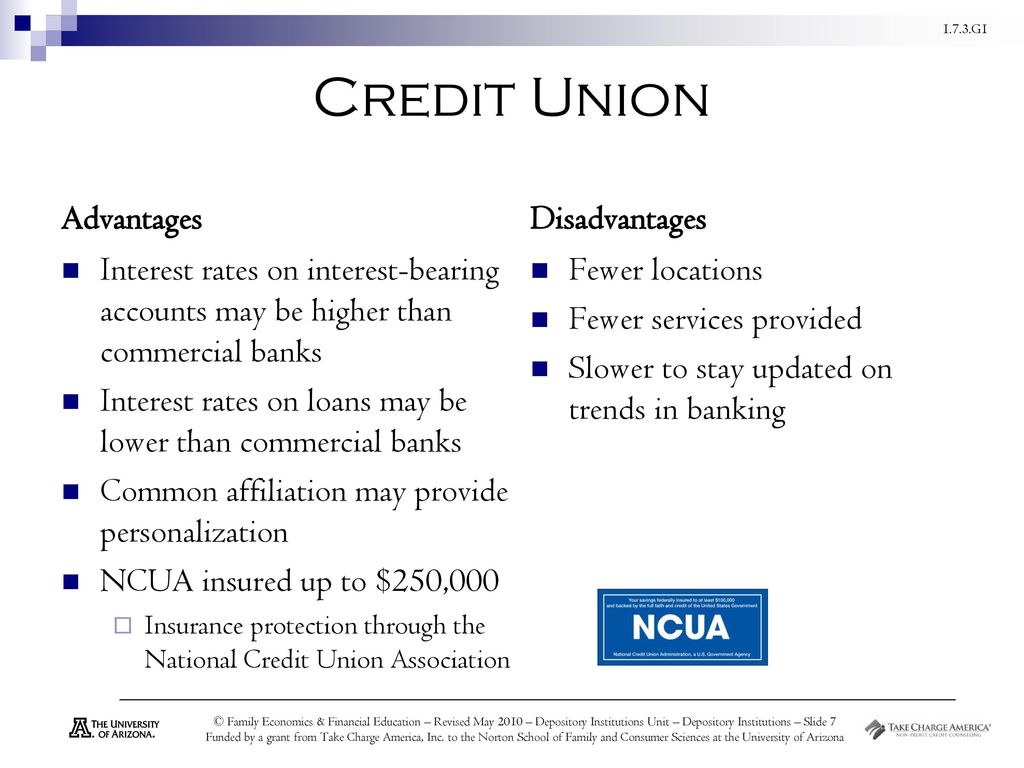

Showing a distinctive strategy to economic services, cooperative credit union provide Resources several benefits over typical financial institutions. One crucial benefit is that lending institution are commonly member-owned, implying that profits are reinvested into the organization to give much better prices and reduced costs for members. This participating structure usually brings about extra tailored client service, as lending institution prioritize participant contentment over maximizing profits. Furthermore, cooperative credit union are understood for their affordable rates of interest on interest-bearing accounts, fundings, and bank card. This can cause higher returns for members who save or obtain money through the lending institution contrasted to conventional banks.

Moreover, lending institution often tend to have a strong emphasis on financial education and neighborhood assistance. They usually give workshops and sources to help participants improve their monetary literacy and make sound money monitoring decisions (Credit Union Cheyenne). By fostering a sense of area and shared goals, cooperative credit union can produce an extra encouraging and comprehensive banking atmosphere for their participants

Community Involvement and Social Effect

By working together with these entities, credit unions can amplify their social effect and address critical concerns influencing their areas. In essence, credit rating unions serve as catalysts for positive change, driving area advancement visit this web-site and social development with their active involvement and impactful initiatives.

Final Thought

To conclude, debt unions have a rich history rooted in neighborhood and teamwork, providing a diverse array of monetary products and solutions with competitive rates and personalized client service. They prioritize the financial health of their members over profit, fostering a feeling of belonging and offering economic education and learning. By proactively taking part in social influence efforts, credit score unions develop a supportive and comprehensive banking atmosphere that makes a favorable distinction in both specific lives and communities.

Friedrich Wilhelm Raiffeisen, a German mayor, is often credited with establishing More Help the initial contemporary credit union in the mid-1800s - Credit Union Cheyenne. By requiring participants to satisfy particular eligibility demands, credit score unions aim to promote a feeling of belonging and shared purpose amongst their members, strengthening the cooperative nature of these financial institutions

Furthermore, credit history unions frequently provide monetary education and learning and counseling to help members improve their economic literacy and make educated decisions. Generally, the range of financial products and services used by credit report unions emphasizes their dedication to fulfilling the diverse requirements of their members while prioritizing their monetary well-being.

In addition, credit unions are known for their competitive rate of interest prices on financial savings accounts, car loans, and credit scores cards.

Report this page